The decision to renounce U.S. citizenship is significant, often prompted by major life changes or frustrations with complex U.S. obligations. Though it can be difficult and costly, the number of Americans choosing this path has increased over recent years. This guide covers the reasons behind the trend, walks you through the renunciation process, and helps you weigh if this path is right for you.

Why Some People are Motivated to Renounce U.S. Citizenship

Renunciation of citizenship is the act of voluntarily giving up citizenship in a country. Citizens of a country may renounce citizenship as a way of expressing philosophical differences, avoiding mandatory military service, becoming asylees or avoiding obligations of tax laws. The United States is no different.

More Americans are choosing to renounce their U.S. citizenship each year, often driven by complex tax obligations, reporting requirements, and lifestyle changes. Understanding these motivations can shed light on why leaving U.S. citizenship feels like the right choice for some.

Tax Obligations Abroad

One of the most common reasons Americans renounce their citizenship is the tax burden associated with the United States' unique global tax system. Unlike most countries, the U.S. taxes citizens on worldwide income, even if they reside abroad. For many expatriates, managing this dual tax obligation becomes financially and emotionally taxing.

Complex Reporting Requirements

Expats are often required to report foreign bank accounts, investments, and other assets to the U.S. government through forms like FBAR (Report of Foreign Bank and Financial Accounts) and FATCA (Foreign Account Tax Compliance Act). Non-compliance with these forms can lead to substantial penalties, making the annual paperwork overwhelming for many individuals.

Lifestyle and Personal Beliefs

For some, renouncing U.S. citizenship aligns with personal, political, or lifestyle beliefs. Living in a country they consider their true home, they may wish to fully embrace that identity without retaining ties to the United States. Others may feel disconnected from the U.S. or seek the freedom that comes with being a single-country citizen.

Ease of International Travel

The U.S. passport can complicate travel to certain countries or regions due to U.S. foreign policies. Additionally, individuals holding dual citizenship in countries that restrict multiple nationalities may find renunciation allows for easier travel and residency without conflicting citizenship statuses.

Cost Considerations

Renunciation can also be a financial choice, as some find that retaining U.S. citizenship costs more than it’s worth, especially for retirees living abroad. Between annual tax filing costs, account compliance requirements, and additional U.S.-based expenses, individuals may feel they are spending too much to stay compliant.

The Renunciation Process: Step-by-Step

Renouncing U.S. citizenship is a formal legal process that must be handled with care. There are major long-term considerations before you make this decision. Here’s an outline of the main steps:

Prepare for the Financial Implications

Before making any decisions, consult a tax or legal expert familiar with expatriation. There are potential exit taxes on worldwide assets for high-net-worth individuals. You may also need to settle any outstanding U.S. tax obligations before renunciation.

File Form DS-4079

Begin the renunciation process by completing Form DS-4079, which is a questionnaire for determining loss of U.S. citizenship. This is generally submitted to the nearest U.S. embassy or consulate.

Schedule a Renunciation Appointment

You’ll need to make an appointment at a U.S. embassy or consulate in your country of residence. Renunciation appointments are in high demand, so expect a waiting period of several months in some locations.

Pay the Renunciation Fee

The U.S. Department of State requires a fee for renouncing citizenship, currently set at $2,350. This fee must be paid during your appointment and is non-refundable, regardless of your final decision.

Take the Oath of Renunciation

During your consular appointment, you’ll need to take an Oath of Renunciation before a consular officer. This step formally severs your citizenship ties to the United States, and the decision is generally considered final.

Receive Your Certificate of Loss of Nationality

After completing the process, you will receive a Certificate of Loss of Nationality (CLN) from the U.S. government. This document confirms that you are no longer a U.S. citizen and will be required for any future interactions regarding former citizenship status.

Considerations Before Renouncing U.S. Citizenship

Renouncing citizenship is irreversible. It’s essential to consider your long-term goals and potential challenges you might face after renunciation. Here are some questions to ask yourself:

- Have you explored alternatives? If tax or financial burdens are your primary reason for considering renunciation, working with a tax professional may provide solutions to alleviate these pressures without renouncing.

- Will renunciation affect your family? If you have family in the U.S., such as minor children, renunciation may impact your ability to reside in or visit the U.S. on flexible terms.

- What are the visa requirements for visiting the U.S.? Once you renounce, you will need a visa to visit the U.S., and your entry will be subject to standard immigration requirements.

Before making the life-changing decision to renounce U.S. citizenship, consulting with an attorney is essential. They provide insights on legal, tax, and financial impacts, helping you make an informed and confident choice.

Frequently Asked Questions about Renouncing U.S. Citizenship

Famous Americans to Renounce U.S. Citizenship

Over the years, several prominent Americans have chosen to renounce U.S. citizenship, a decision often driven by personal, financial, or lifestyle factors. From legendary entertainers to influential entrepreneurs, these individuals have left behind their American citizenship to embrace life abroad. Their stories reflect the diverse motivations—ranging from tax considerations to the pursuit of a different cultural identity—that can lead someone to make this significant and often emotional decision.

Eduardo Saverin, a prominent Facebook co-founder, renounced his U.S. citizenship in 2011, and moved to Singapore. The Wall Street Journal estimates that the move saved Saverin an estimated $700 million in capital gains taxes.

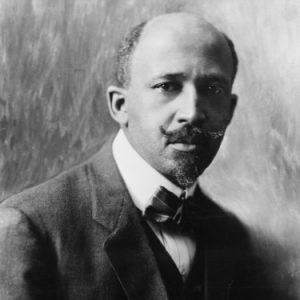

W.E.B. DuBois was a noted writer, historian and sociologist who co-founded the NAACP. However, he grew increasingly radical throughout his life and eventually embraced the principals of communism. He renounced his U.S. citizenship and lived out his final years in Ghana.

Terry Gilliam, a member of the Monty Python comedy troupe, is the group’s only American born member. Gilliam spent several years as a dual citizen of the U.S. and England but finally decided to renounce U.S. citizenship in 2006 as the estate tax loomed.

Tina Turner, one of America’s most legendary singers, became a Swiss citizen. Turner’s romantic relationship eventually led the couple to settle in Switzerland. She naturalized in Switzerland and renounced her U.S. citizenship in 2013.

Ted Arison immigrated to the U.S. from Israel to make millions. He co-founded Norwegian Cruise Lines and later founded Carnival Cruise Lines. Arison even owned the Miami Heat. But the crushing blow of taxes led him to renounce U.S. citizenship in 1990 and return to Israel.

Queen Noor of Jordan was born as Lisa Halaby in Washington D.C. But when she married King Hussein, she was forced to renounce her U.S. citizenship and become a Jordanian citizenship in 1978.

Bobby Fischer was an American chess prodigy and grandmaster whom many consider to be the greatest chess player of all time. After becoming the 1972 World Chess Champion, Fischer fell in and out of trouble until he found asylum in Iceland as a citizenship in 2005.

Barbara Hutton as an American socialite and heiress to the Woolworth fortune. Hutton would marry seven times, and two of those marriages resulted in citizenship changes. She became a Danish citizen for her second husband and Dominican citizenship for her fifth husband.

Earl Tupper was the founder of Tupperware. Without much warning, he sold his company in 1958 for $16 million, renounced his U.S. citizenship, and purchased an island off the Costa Rican coastline.

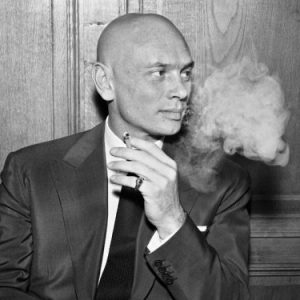

Yul Brynner was a Russian-born actor who held dual Swiss and U.S. citizenship. However he lost his tax exempt status by working too long and chose to renounce U.S. citizenship in 1965 to avoid being bankrupted by the taxes and penalties.

Elizabeth Taylor, the Hollywood icon with eight marriages to seven husbands, tried to renounce her U.S. citizenship in 1965. Taylor couldn’t bare to take an oath that she would “abjure all allegiance and loyalty to the United States.” The State Department turned down her request.

Government Reporting of Renunciation

The U.S. government publishes a list of Americans who renounce U.S. citizenship each quarter. The Quarterly Publication of Individuals, Who Have Chosen to Expatriate, as required by Section 6039G, is a publication of the Internal Revenue Service (IRS) in the Federal Register. It lists the names of certain individuals with respect to whom the IRS has received information regarding loss of citizenship during the most recent quarter.

About CitizenPath

CitizenPath provides simple, affordable, step-by-step guidance through USCIS immigration applications. Individuals, attorneys and non-profits use the service on desktop or mobile device to prepare immigration forms accurately, avoiding costly delays. CitizenPath allows users to try the service for free and provides a 100% money-back guarantee that USCIS will approve the application or petition. We provide support for the Naturalization Package (Form N-400), Certificate of Citizenship Package (Form N-600), and several other immigration services.

Want more immigration tips and how-to information for your family?

Sign up for CitizenPath’s FREE immigration newsletter and

SAVE 10%

on our immigration services